Overcoming the fear of loss (Seller’s Remorse & Buyer’s Remorse)

Both scenarios below have the same point of resistance from the customer. The customer is afraid of missing out on a better deal. They fear seller’s/buyer’s remorse so much, they will defy the historical information that it’s time to sell grain/contract feed. Research tells us the fear of loss is two times stronger than the anticipation of joy from gaining. What does this mean? It means, I’m more afraid of making a decision because I will miss out on a result versus having the joy of something better. Here’s how it plays out on a sales call at a grain or livestock producer.

Farm Call 1: Buying grain in February from a producer that is completely unhedged

“Greg, I don’t think I’m going to lock in any prices with you today. I think we’re going higher.”

“OK. Have you bought the seed? Locked in the land rent and did some fall fertilizing to prepare for this coming year?

“Yes”

“Have you sold any new crop at all?”

“No, like I said, I think we’re going higher. South America…..China….. drought…..floods… Besides, I locked in prices in early 2012 and lost a lot of money. I was delivering $5 corn in a $7 market. I’m not missing out again if this thing goes to the moon”

“Even if you can lock in a decent price today and guarantee a margin per acre?”

Farm Call #2: Contracting feed in October with a poultry producer

“Greg, I don’t think I’m going to lock in any feed prices today. What if prices come down?”

“OK. Have you purchased the chicks, own the buildings and locked in your selling price to your customer?”

“Yes”

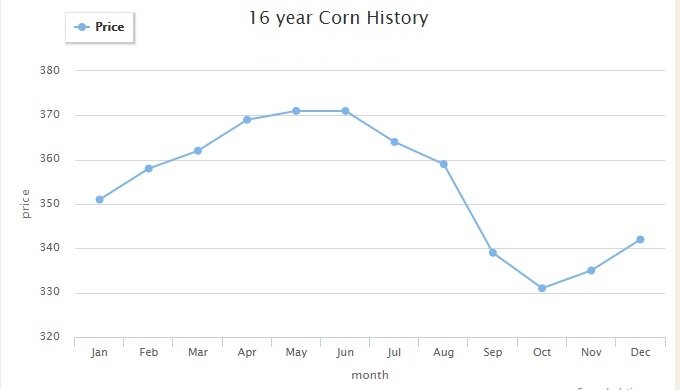

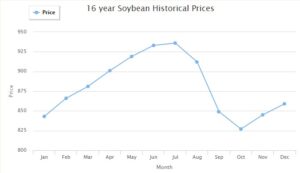

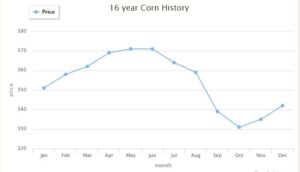

I have been on way too many farm calls that play out just like the above conversations. For some reason, it can be difficult to explain that you are actually removing risk from your operation by locking in a price. In some cases, they have their selling price and all costs except their feed price locked in. With feed being roughly 50% of variable expenses, a producer is exposed to the volatility of feed ingredient prices. In the case of grain, everything has been committed to corn or bean production including fertilizer, seed and land rents. They are now exposed to the yield and market swings. If you were to chart the last 15 to 20 years of corn and beans you would see a trend of rising prices in the Spring that trail off in the Fall. Of course, there are several recent years where we had a Fall run up in grain/feed prices. This led many producers to react by not locking in so they won’t miss the possible run up.

Factors to keep in mind

- Do what they always do: Under stress or ambiguity, customers will revert back to doing what they always have done. Why? Maybe they are either confused, unsure or don’t have the time to make the decision. So, they take what they think is the safest route – status quo.

- Fear of doing something different than their peers and they will look foolish: This is a very powerful fear in the Ag world as it is a very small community. So, you have to maintain discretion and not violate any customer’s confidentiality. Word travels fast at the coffee shop.

- Fear of not delivering on contract: This can be very strong for grain producers that worry they may not produce the crop. To deal with this, contract in percentages of APH on planted acres and stay at a comfortable level. But do understand, there are producers who have a strong fear of cancelling grain contracts.

- Multiple decision makers: Often times, there are multiple people on the farm involved in the decision. Sometimes the producer won’t tell you until you push for a commitment. They might be afraid of doing something out of the ordinary like forward contracting. The producer is ok with doing what they always have done, but might be worried that doing something different will bring criticism from his family.

Things you can do:

- Use questions as opposed to statements: The questions I used in my examples in the beginning of this story were less indicting than saying something like, “You know if you don’t contract now, you could be selling grain below break-even.” This can make the person resist your discussion, dig in their heels and justify why they aren’t contracting. In my example, those questions would be spread out a little over the conversation so they don’t sound like an inquisition. Other forms of questions can be:

- “Have you ever…? For example, “Have you ever viewed forward pricing as removing risk from your farm?”

- “A guy could…” I’ve mentioned this in the past. I had a sales manager that used this technique very effectively. He would say something like “A guy could lock in 15-20% now and then come back later and do another 15% to spread out the risk.” It is more of a statement that would invariably instigate a response.

- Another statement format is “Some producers are….” For example, “Some producers are locking in 25% of their feed needs in anticipation of the volatility around the crop.” Obviously, this needs to be true and you need to keep it to “some producers” as you don’t divulge confidential info.

- Let the questions sink in: Some people need time. So, even if you don’t get the response you thought you would get, check back in a day or so. Sometimes they need to think about it, stew on it or ask their peer, family member, etc. One time, a Home Depot sales person asked if I was going to remodel my kitchen. I thought on it several days before a certain member of my family gave me my answer. When I went back, the salesman said he was glad I reconsidered. Truly, I don’t think he was since I then saw him every other day for six months while I completed the project.

- Emphasize the decision to not do anything is actually a decision. Most of the time, the decision to not do anything, leaves the customer exposed to risk.

- Start small: If a person has never booked feed or forward contracted grain, don’t present a complicated plan that locks in 50% or has multiple open ended pricing components. 10-20% is a good start and gets their feet wet. You could call it a gateway product. Probably not a very positive term but a gateway product is just that. It’s a less risky way to start someone on a program. I say this, not as a manipulation, but as something that truly fits their operation.

- Go big picture, then back down to detail: If you are mired in the details, go big picture and explain things from a 10,000-foot level. Then you can get back down into the weeds. I see a lot of sales conversations that get stuck in the weeds and neither sales person nor customer ever get to the point of a complete marketing or contracting program. Ever walk in and start the sales call off with a discussion on an invoice or settlement sheet and never get to contracting new crop? Or get bogged down in what happened to Uncle Paul in 1983 when he did something with the loan program? Yes, small talk is part of the process. But, keep it small just like its name. Get back to the big picture of how you can help reduce risk.

- Emphasize the cost of risk: Many times, customers don’t understand that risk costs money. Compare it to insurance. When you lock in the price for a customer, your company is now exposed to that risk until hedged. This all costs money or takes a calculated risk assessment cost (a gamble). Said another way, if we lock in feed prices with you today and the price goes down, it appears that we made money. If we didn’t hedge it, then yes, we made money. By gambling! Or we forgot to hedge it and got lucky. Either way, that can appear to a customer that we just made profit at their expense. My reply to that is just as I said. If we did, it was a gamble. Had it gone the other way and we lost, we probably wouldn’t be having the conversation. The customer would most likely be remarking how happy they are that they contracted.

In summary, be aware of the fear that your customer might have of “missing out” on better prices. It can be very powerful and can take several attempts for both of you to understand your points of view. Good luck!

Bring me in to present at you next sales meeting or trade association event, contact me at Greg@GregMartinelli.net

For more on Ag Sales Training, Ag Sales Coaching and Leading Ag Sales Teams, go to http://www.GregMartinelli.net/